America's Money Experts

Discover the quickest way to get out of debt and fix your credit

About Money Advice USA

We work with some of the America’s leading debt partners, and can offer you a debt solution to help you write off your unaffordable debt.

Our first job is to listen. There is no one size fits all solution, it all depends on your individual circumstances. Once we know your situation we can explain the different options available to you.

How you decide to move forward is up to you. There are solutions for everything, some simple, some more complex – once you know the options available you can choose what suits your personal situation.

Take Quiz

Frequently Asked Questions

Debt consolidation involves taking out one big loan to pay off many small loans (or credit cards, etc). The new loan will have a lower interest rate so whilst you still pay back all of your debt, you will pay significantly less in interest.

Put simply, if a lender looks at your situation and thinks there is a chance you won’t be able to pay any of your debt, they would rather agree to a reduced figure than get nothing. Our partners negotiate a settlement figure on your behalf that is structured into a monthly payment you can afford.

Don’t be fooled in to thinking there is a magic wand to stop lenders chasing. They will stop when they are happy that there is a solution in place that they agree to. The sooner you address the problem and meet with an adviser to put together a plan, the sooner your lenders will stop chasing you.

It depends. Your initial consultation with a Debt Solution provider should always be free. They will assess your case and work through the options one by one. If your case can be solved through good advice, budgeting and better financial planning, they will probably invite you back for a more detailed meeting where they will put a plan in place – they will likely charge a fee for this like any professional service would.

Most debt solutions will allow you to keep your assets. However, there are some options such as bankruptcy that may require you to give up some or all of your assets. Your adviser will always recommend the best solution for your personal circumstances.

Debt solutions do not require you to pay anything more than you can comfortably afford, this is one of the main aims of all debt solutions. We understand your standard of living is more important than what lenders may be demanding you pay. Our aim is getting you debt free in a reasonable time frame at a rate you can afford, this can include getting a portion of your debts written off.

We can assist with the following debts: Credit cards, Unsecured personal loans, Payday loans, overdrafts, catalogue debts, property tax arrears, IRS Arrears, Student Loans.

How We Can Help

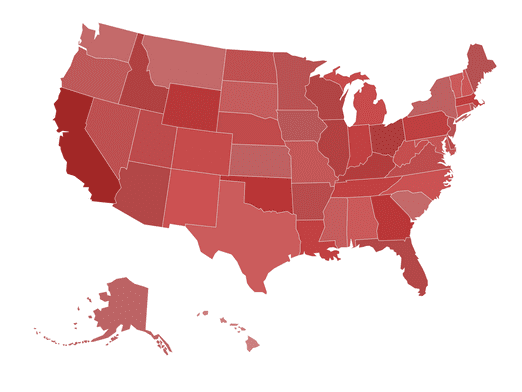

Americans have one of the highest consumer debt profiles in the world coupled with rising living costs, record housing costs and an uncertain economic future. It’s a recipe for a disaster on a national scale.

Now is the time to take control of your finances and rid yourself of crippling debt by using all the tools available.